What Is Debt-to-Income (DTI) Ratio and Why Does It Matter When Getting a Home Loan?

When applying for a home loan, lenders look at several factors to determine your ability to repay the mortgage. One of the most important factors is your Debt-to-Income (DTI) ratio. Understanding what it is, how it's calculated, and why it matters can help you prepare for the home-buying process and improve your chances of getting approved for a mortgage with favorable terms.

What Is Debt-to-Income Ratio?

Your DTI ratio is the percentage of your gross monthly income that goes toward paying your debts. Lenders use this number to evaluate your financial health and determine how much home you can afford.

A lower DTI ratio shows that you have a good balance between your income and your debts, making you a lower-risk borrower. A high DTI ratio, on the other hand, might indicate that you are overextended financially and could struggle to keep up with mortgage payments.

How to Calculate Your DTI Ratio

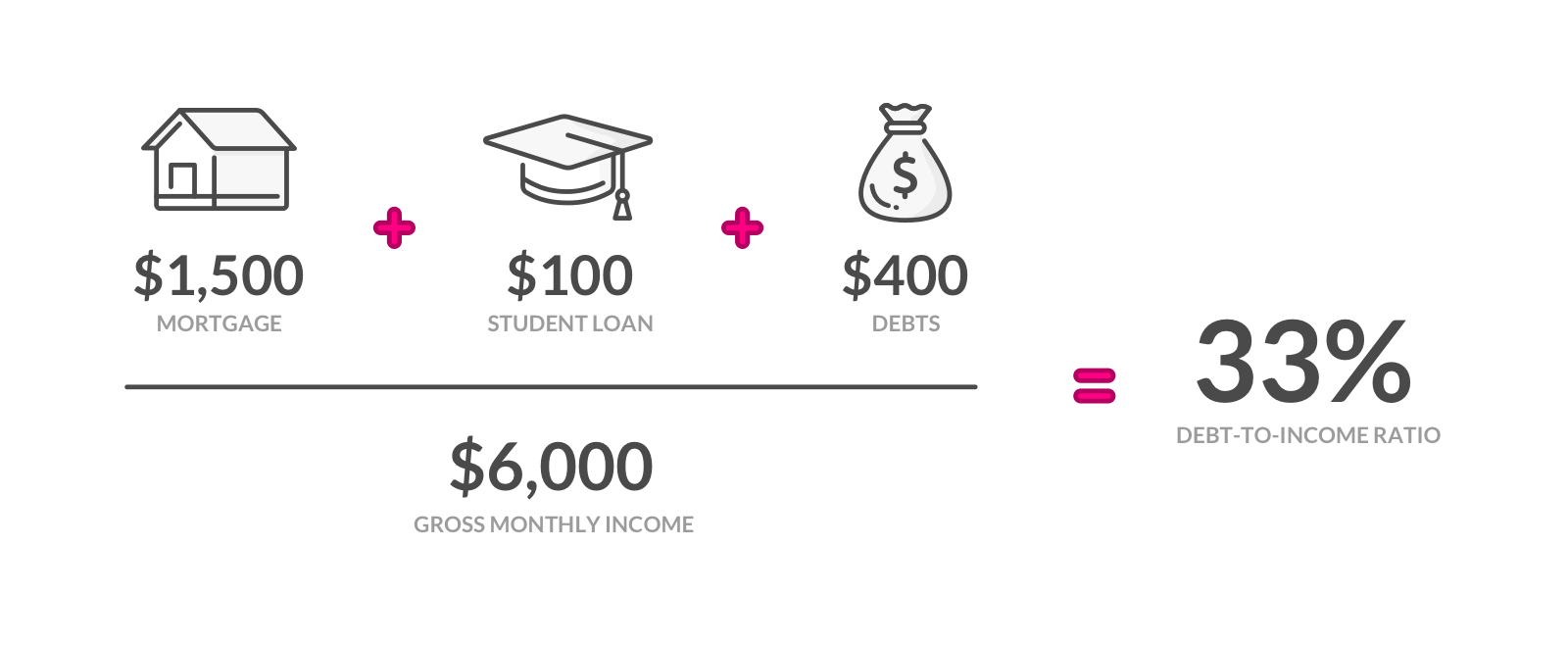

To calculate your DTI ratio, follow this simple formula:

DTI Ratio = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

Step 1: Add Up Your Monthly Debt Payments

This includes:

✅ Mortgage or rent payments (if applicable)

✅ Car loans

✅ Student loans

✅ Credit card minimum payments

✅ Personal loans

✅ Any other recurring debt obligations

📌 Example:

- Car loan: $400

- Student loan: $300

- Credit card payments: $150

- Personal loan: $200

- Total Monthly Debt = $1,050

Step 2: Determine Your Gross Monthly Income

This is your pre-tax income from all sources.

📌 Example:

- Gross Monthly Income = $5,000

Step 3: Divide and Multiply by 100

$1,050 ÷ $5,000 = 0.21 (or 21%)

Your DTI ratio is 21%.

Why Does DTI Ratio Matter for a Mortgage?

Lenders use your DTI ratio to determine if you can handle additional debt from a mortgage. The lower your DTI, the more likely you are to qualify for a loan with better interest rates and terms.

What Are the Ideal DTI Ratios for Mortgage Approval?

Most lenders prefer the following guidelines:

✅ 36% or Lower – Ideal! Most lenders consider this a strong ratio, making you more likely to qualify for a mortgage with lower interest rates.

✅ 37% - 43% – Still within acceptable limits. Many conventional loans and FHA loans will approve borrowers in this range, but terms may not be as favorable.

⚠️ 44% - 50% – Riskier range. Some loan programs, like FHA or VA loans, may still approve you, but expect higher interest rates or additional requirements.

🚨 Above 50% – High risk. Approval is very difficult, and you may need to pay off debt before applying.

How to Lower Your DTI Ratio Before Buying a Home

If your DTI ratio is too high, here are a few ways to improve it before applying for a mortgage:

✅ Pay Down Debt: Focus on reducing credit card balances, car loans, and other outstanding debts.

✅ Increase Your Income: If possible, take on extra work, ask for a raise, or find additional income sources to boost your earnings.

✅ Avoid New Debt: Don't take on new loans or credit card debt before applying for a mortgage.

✅ Make Extra Payments: If possible, make extra payments toward existing loans to lower your overall debt.

Final Thoughts

Your Debt-to-Income (DTI) ratio plays a major role in determining your mortgage eligibility and the type of loan you can secure. Keeping your DTI low improves your chances of approval and helps you get the best possible interest rates.

If you’re unsure about where your DTI stands or need help navigating the home-buying process, I’d love to assist! Contact me today, and let’s get you on the path to homeownership. 🏡💙

Categories

- All Blogs (45)

- Builder (13)

- Buyer (34)

- Closing Costs (11)

- First Time Home Buyer (21)

- Friendswood Neighborhoods (2)

- Ground up (2)

- Incentives (9)

- Just Fun (3)

- League City Neighborhoods (3)

- Manvel Neighborhoods (2)

- Meridiana (2)

- New Construction (15)

- New Homes (11)

- Pearland Neighborhoods (3)

- Real Estate (21)

- Real Estate Agent (22)

- Realtor (16)

- Relocation (11)

- Seller (19)

Recent Posts